Cape Breton is an interesting real estate market with (1) out migration, (2) an influx of Western oil money, (3) aging homes, and (4) high energy costs. Here are 6 critical tips (plus one bonus) to help you avoid getting ripped off… coming from a buyer just like you.

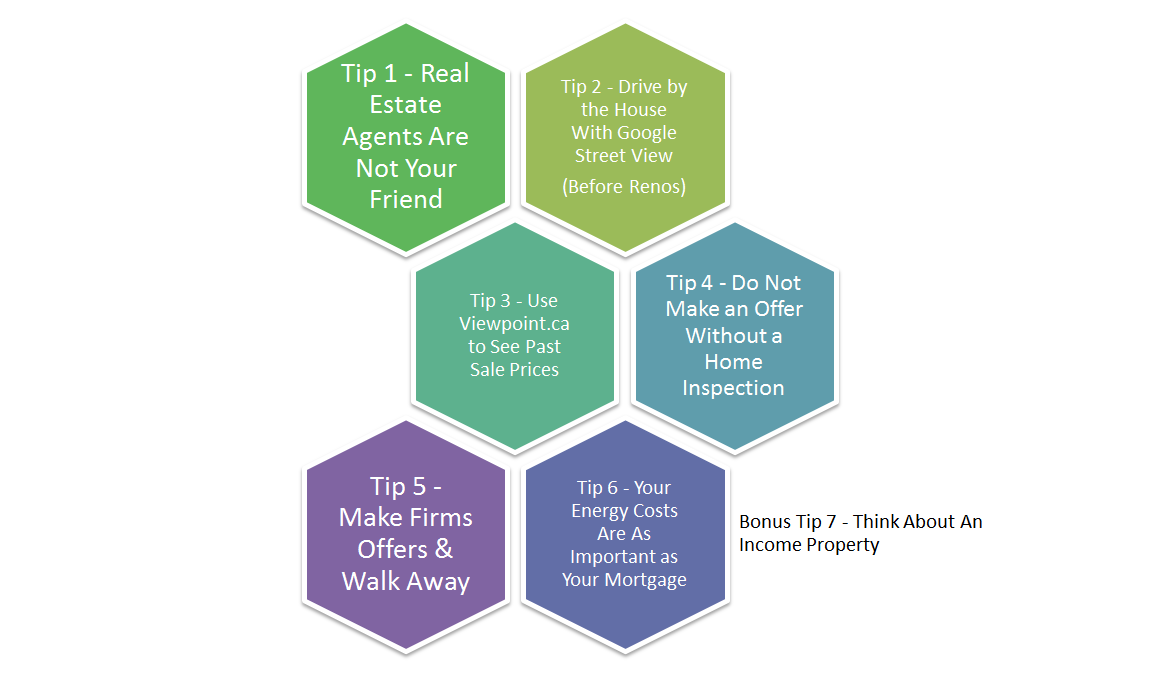

Tip 1 - Real Estate Agents Are Not Your Friends

This is probably the most important thing for you to understand. It doesn't matter if the real estate agent represents you or the seller. Their goal is the same. They are in the business of selling homes and earning commissions in the process.

Many of them are great people, and very sharp. But the only person that is always going to be most committed to your bests interests is you.

Challenge them on everything. Make sure they represent your best interests in every way. This isn’t meant to be antagonistic. For most, buying a home is the single largest investment they will make in their entire lives. Overpaying or buying a money pit doesn’t just hurt you financially, it can impact your entire life. That means not just the 15-30 years worth of a mortgage, but also your retirement years thereafter.

Be courteous, but assertive. You want to pay market value only, and you do not want to fall into any traps. The next 3 tips are going to give you a leg up.

P.S. If you do have a real estate friend, chances are you’ve heard them off the record over a beer. And you probably have insights into what their biggest motivation really is.

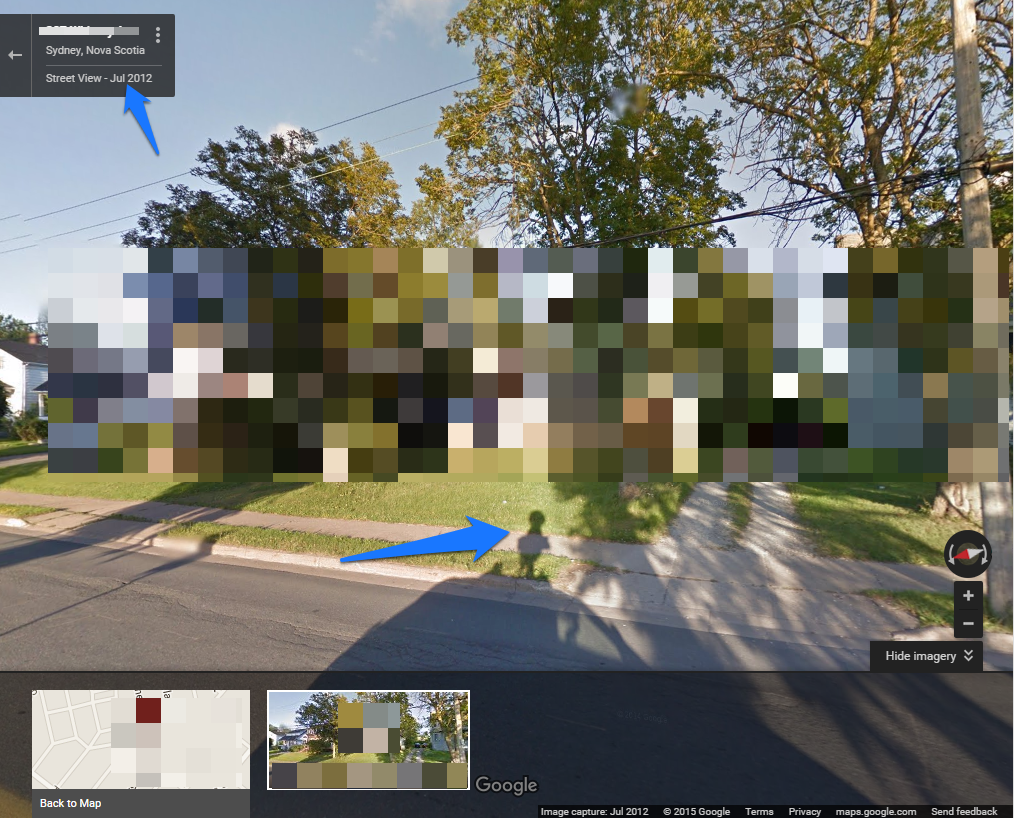

Tip 2 - Drive By the House Back in the Past with Google Maps and Street View

If you enter an address at Google Maps, you can switch to “Street View”. Street View actually lets you see what the house looks like if you were walking or driving by.

Google has a fleet of cars all over North America that drive all of our streets, taking images of everything as they go.

But this gives you a helpful advantage when buying a house. You see there is a significant delay in the amount of time it takes for Google Street View cars to return to each location.

The time between their last visit and their next gives you a view into the past for the neighborhood.

In your house search, many of the homes that you will see listed will have been renovated. Some add curb appeal with landscaping, and new windows and siding can make a home look almost like a new build.

But how do you know that’s not a facade?

I’ve talked to local contractors that have told me that some of the renovations you see done are quick fixes. My source says that underlying issues in the home structure or issues not resolved can lead new buyers to get ripped off. The facade gives you the impression that you are getting a modernized home with no major issues. And that quite likely may be a big mistake.

Your offer price has to reflect not what a home looks like it’s worth on the exterior or new interior design elements, but what it is actually worth.

Paying for a facade means that you are probably drastically overpaying - and you’ll find that out when the major issues reveal themselves later.

Don’t expect your real estate agent to start talking about what issues might lurk underneath it all. They are much more likely to tell you about all the great upgrades and get you excited.

So how do you use Google Street View to your advantage?

Use it to see how the house and exterior looked the last time Google cars photographed it. If it was a major wreck before, then you might want to walk on the deal. Alternatively, use that knowledge to insist on full disclosure of what work was done - and to use it to negotiate a significantly reduced price.

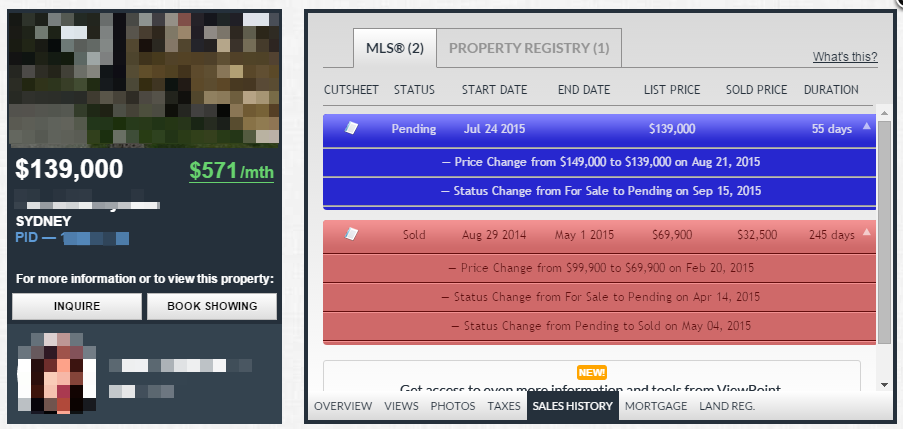

Tip 3 - Use ViewPoint to Know What They Paid For It and How Motivated They Are to Sell

Make viewpoint.ca your best friend. Anytime you find a new listing (either through an agent, Property Guys, or Kijiji, etc), check it out on viewpoint.ca immediately.

Viewpoint.ca gives you excellent information about the home including its history of tax assessments and estimated annual taxes, a limited history of its selling price, and a history of its price changes when listed with an agent.

I’m aware of a home now that has a pending offer for $139,000 that was sold for $32,500 in 2014. While there was significant work done on the home by all appearances, there is a full $106,500 gap.

Would you want to pay a $100,000+ premium over the price that the seller paid about 1 year ago?

That is one way to singlehandedly set your family’s financial future up for failure.

So your job is to know what any house you are considering sold at in the past. Note: the data only exists for the past 5 years (starting in June 2010). However, you absolutely must check to see if there is a selling price history - and use it to your advantage in negotiation.

But there is an additional strategy for you.

Viewpoint also tracks the asking price changes when the property is listed with real estate agents. You can see when it was listed, how long it's been on the market, and whenever the asking price has been changed.

If you see a home has been on the market for a long time and the homeowner is dropping the price, then you know you have a motivated seller. If you are preapproved and have a serious offer, you can use that knowledge to negotiate an additional drop in price.

Never pay the asking price. Real estate agents always add wiggle room there. It’s the nature of sales. They know that dropping $5,000-$10,000 is a helpful way to push a sale through while also getting the exact price really desired for a home.

When you see a homeowner dropping the price, you have the upper hand to negotiate additional incentives. You can let your agent know you are aware of it, though you don’t have to disclose your special advantage to the seller.

Tip 4 - Do Not Make An Offer Without Making a Home Inspection (No Major Issues is Mandatory)

If you have experience in the trades or have a family member that can help you, that is great. However, that won’t be sufficient to evaluate the entire home for issues.

There are many homes in this area that may look great inside and out, but have major issues:

-

Asbestos (Attic, walls, piping)

-

Old wiring

-

Old and degrading plumbing

-

Expired or soon to be expired oil tanks

-

Major structural issues (uneven floors will continue to degrade)

-

Major structural issues in foundation/basement

-

Significant leaking in basement foundation

-

Old or improper insulation

-

Aged and non-energy efficient windows and doors

-

Old and inefficient furnaces

-

Improper weather barrier on home exterior

-

Improper basement insulation

-

Elements that are not up to code

-

Modified apartments that don’t meet code, lack of egress windows or fire exits, etc.

-

Aging roof nearing the need for replacement

-

Old fireplaces or chimneys that are nonfunctional and may jeopardize insurance coverage

-

Aging barns, sheds, garages that will require expensive removal costs

These things are just off the top of my head from viewing several homes in the Sydney area. In fact, I’ve even looked at a home from a major local business owner that had an elderly lady in a 3rd floor apartment death trap with no fire exit, old knob and tube wiring with no ground near her kitchen sink, and no door to her apartment (you have to walk through the 2nd floor apartment to get to hers).

That home just so happened to also have a leaking basement, asbestos, all old wiring, and a ready to fail main sewage line that would require the whole front yard to be dug up when it fails. Buyer beware indeed.

So you need a professional home inspector to go through every part of the home before you make your biggest financial investment.

Some even advocate having separate expert tradesmen view the house. A carpenter, electrician, and plumber will certainly be able to spot major issues quickly - and more accurately than most home inspectors.

Don’t rely on your bank or mortgage broker to do this work for you. They often have their appraiser simply drive by the house for a quick look. They see what it looks like, check the comparable sales of other homes that have sold in the area, and put a price on it.

As long as the home can be insured, and its appraisal value is high enough to justify giving you the mortgage, that’s as much as your lender is really going to bother with in most cases.

They are not going to forgive you from paying your mortgage because you later find out you have a $25,000 asbestos mitigation project on your hands - to ensure your family doesn’t end up with cancer.

Tip 5 - Make Your Offers Firm and Walk Away

With out-migration from Cape Breton (i.e. 450-500 less students per year), this is a buyer’s market. Once you’ve armed yourself with enough information to know what issues exist, what it will cost to fix, and what the true value of the home is... don’t pay anymore.

Don’t buy it because it has charm, you love the location, or you got your hopes up. There will always be another that brings you the same feelings at a fair value and without having to accept nightmarish issues.

Make an informed and firm offer and walk away. Remember, sellers are not sophisticated about matters of real estate on average. They are selling what they loved for a time, and what they have invested in. We can understand why they may overvalue it. Again, we’re not being antagonistic. We tell them what we will offer and why that offer is less than what they might be expecting. There is nothing discourteous about both buyer and seller insisting on a fair deal. And that’s ultimately what you or the seller will be paying your real estate agent to do.

Tip 6 - Your Energy Costs Are As Important as Your Mortgage

One of the best things you can do for yourself and your family in Cape Breton is buying just enough house for your needs. You don’t want to underestimate and end up in a home you will outgrow too quickly. But you also must not buy more house than you need.

You might love older style homes with multiple stories. Many of them just give us a feeling of nostalgia, or some feeling of charm that many older homes offer. But the energy costs of trying to heat extra square footage may turn out to be a disaster - truly leading you to many winters of discontent and either empty oil tanks or empty wallets and purses.

Insist on knowing the heating costs for the home and do an intense evaluation as to whether you really need the extra space it offers. Because you absolutely will pay for it dearly.

That’s also one of the leading reasons the most popular homes on the Cape Breton real estate market are newer and smaller square footage, single story bungalow style homes.

Heating costs matter. There are homes when winter oil bills will rival or exceed your mortgage itself. And even with those high energy costs, you might still be left with drafty cold spots and the need for extra blankets.

Bonus Tip 7 - Think About An Income Property

Regardless of what price range of a home you buy, one great way to not only offset your energy costs, but also have someone else help pay your mortgage is to buy an income property.

If the property offers a basement suite or has a separate apartment of some sort, they can often effectively pay your entire monthly mortgage for you. Alternatively, you can consider homes that have the potential for conversion through renovations.

There are likely thousands of older homes in Cape Breton that are terrible investments due to energy costs, unless they have or can add an apartment.

Becoming a landlord and having someone else live in a part of your home is not for everyone. But for those who are willing to do so, it can offer major personal financial advantages. Just look at the rates on Kijiji to see what rental apartments are going for.

I’m Not an Agent, I’m a Buyer Like You

Remember, I’m a buyer like you. These tips are what I have established for myself throughout my experiences viewing various houses - and seeing many that were nightmares waiting to happen.

When the time comes, many of you will be working with real estate agents to negotiate your purchase. Just make sure that you address all 7 of these tips with them. Let them know that you have an awareness of the process and things to look out for. They will serve you much better when they know that they are dealing with an informed buyer.

And it will definitely impact the choices of homes that they show you. They are not going to waste time showing you homes that they are already aware have the sort of issues that you told them you don’t want to deal with.

If they tell you that they don’t think anything is going to meet your expectations, you have two responses:

-

I’m in no hurry to buy a money pit. Call me when you have something good.

-

If you find me something with issues, make sure the price reflects the home's true value, and leaves room for me to correct them.

It might not be that often that you find something perfect. However, if you pay only what a home is truly worth, you can make investments in improving it later. But know what you’re getting. And never overpay.

There are all kinds of traps in this market, with many flippers who are very skilled at making minimal facade investments to make a home sell.

For as long as we are seeing economic decline in Cape Breton, and people moving out, this real estate market will always be shifting more in favor of the buyers.

As a fellow buyer, do you have any additional tips?

23

Log In or Sign Up to add a comment.- 1

arrow-eseek-e1 - 6 of 6 itemsFacebook Comments