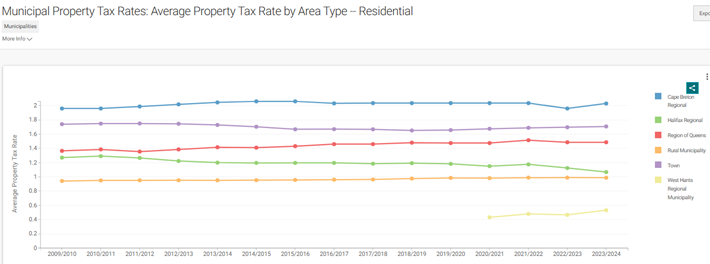

Maybe simple visuals will help us understand the taxation and equalization situation we have going on here in this province. You can clearly see that the HRM’s property taxes are trending downwards while the CBRM trends upwards.

Now here is what the constitution says why equalization is provided to a receiving province:

“Parliament and the government of Canada are committed to the principle of making equalization payments to ensure that provincial governments have sufficient revenues to provide reasonably comparable levels of public services at reasonably comparable levels of taxation”

The CBRM, Provincial and Federal representatives had better start to provide explanations to the residents who are paying some of the highest property taxes in North America while we watch the HRM pay less than half what we do in the CBRM.

It is time that our elected representatives, who are paid handsomely to represent us, started doing their job and earning their pay.

CBRM Taxes Trending Upwards While HRM Trends Downwards.

Posted by

Nova Scotians for Equalization Fairness

Receive news by email and share your news and events for free on goCapeBreton.com

SHOW ME HOW

https://capebreton.lokol.me/cbrm-taxes-trending-upwards-while-hrm-trends-downwards

Gov Government News Federal Government

Gov Government News Municipal Government

Gov Government News Provincial Government

Gov Political Commentary

Location Canada

Location CBRM

Location World

View all the LATEST

and HOTTEST posts

and HOTTEST posts

17

Log In or Sign Up to add a comment.- 1

arrow-eseek-e1 - 7 of 7 itemsFacebook Comments