Equalization 2024-25.

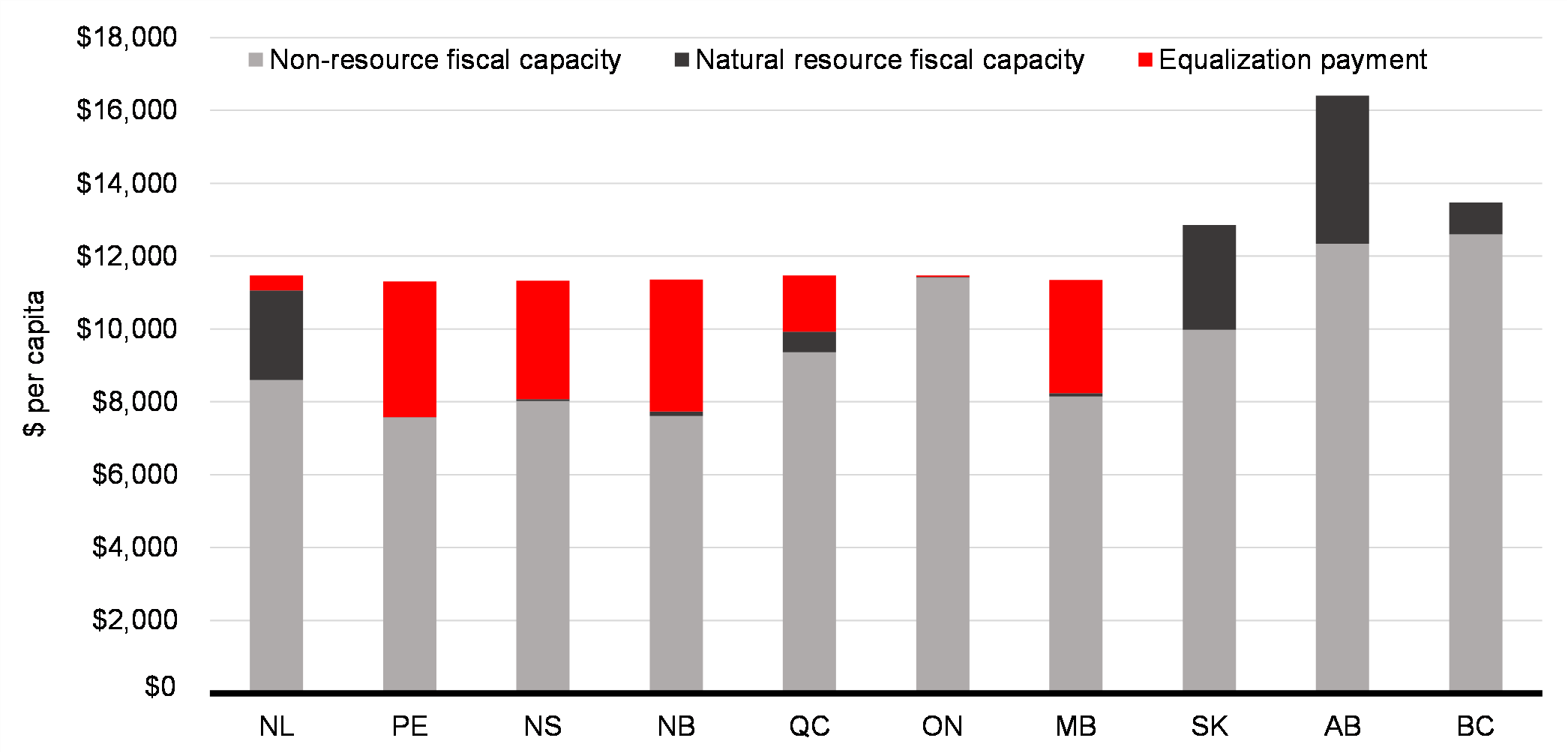

The intent of the Federal equalization program is to equalize reasonably comparable public services with reasonably comparable levels of taxation across our vast country. Natural resource fiscal capacity is obviously the big focus of the resource rich provinces, but non-resource fiscal capacity shortcomings are part of the intent with this program too.

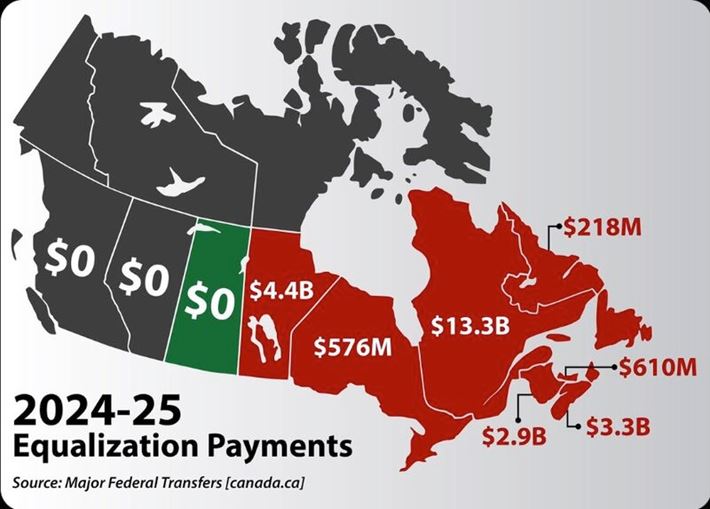

Premier Scott Moe (Sask. $0 in equalization) weighed in on the topic via Twitter/X on Dec 15, 2023;

"As Guilbeault and Trudeau commit to move away from fossil fuels, let’s have a look at the new equalization payments to provinces for 2024-25 to see how energy producing provinces help support the rest of Canada."

Premier Moe got 6.1k likes and over 1,000 comments on his Tweet/X post.

On a per capita basis Quebec, with a population of over 8.5 million receives $1,600 per (not really, but to put these payments in context from a scale perspective), roughly 1/2 the per capita equalization payment of PEI ($3,900), NB ($3,740), NS ($3,300) and Manitoba ($3,200).

In Nova Scotia, HRM (Halifax Regional Municipality), boasting 40% of Nova Scotia's 1 million residents, hoards the lion's share of the $3.3bln. As the centre of government in the province, Halifax has an enviable position in terms of fiscal capacity, especially when compared to Cape Breton Island.

Poorly named CBRM (Cape Breton Regional Municipality) is the 2nd largest municipality in the province. The last change of government provincially was in part due to a "handful of magic beans" commitment to "double" the Municipal Capacity Grant to CBRM from $15 million to $30 million. The "bonus" has been confirmed as a 1-time deal, trickling down to the real economy via a cut in property taxes. With a budget of $174 million, $15 million is almost 9%. CBRM taxes, already excessively high vs. HRM are slated to increase by 3.5%, to help bridge the CBRM budget deficit resulting.

With a CBRM mayoral race set for 2024, expect equalization to lead the issues that get the new (old) mayor and councillors back in their seats.

The current equalization formula is set through March 1, 2029. Inflation math is taking hold.

Alberta has floated leaving the Canada Pension Plan in favour of a stand-alone provincial plan.

Carbon tax relief for heating oil (3-years) has not been well received by the west. The exemption for heating oil solely is seen as a way for the minority government Liberals to keep hold of the 30+ seats in the 2025 federal election. NS lacks the infrastructure for natural gas options. 17% now heat their homes via heat pumps (payback sub 5 years) and there are just over 4,000 residential solar arrays (including the author, payback 8.5 years).

Things are heating up! COP28 in Dubai UAE is a wrap. A sub agreement from 140+ countries to treble renewable energy by 2030 was lauded as progress, but a 1st time agreement on fossil fuels proved more elusive. Wordsmithing at its finest. There are a lot of election cycles between now and 2050, remember that.

Our dominant neighbour to the south seems to be doing a victory lap on executing a "soft-landing" (no recession). The Federal reserve's latest "dot-plot" reflects 75bp in interest rate cuts for 2024, but the Fed's forecast for the economy despite approx. 3.5% GDP growth is a 90% recession probability! (note: deficit spending is running at 7%+ of GDP in the USA). For Canada, stagflation is a bigger risk. Sticky inflation and no growth.

Heady concerns, but let us pause for a holiday celebration with family and friends. Merry Christmas one and all. Cheers, Caleb Gibbons

5

Log In or Sign Up to add a comment.- 1

arrow-eseek-e1 - 4 of 4 itemsFacebook Comments