Good for Wal-Mart

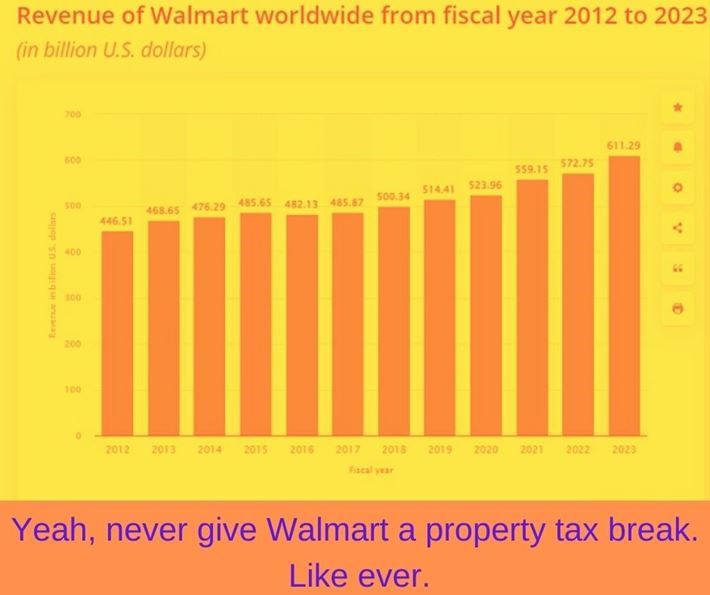

If you are watching the CBRM budget talks right now, you are listening to councillor after councillor say that they have no problem cutting Wal-Mart's property tax rate.

I think that we should be grateful that Houston did not give this council more than 15 million - a one-time fifteen million payment.

Who would they prioritize next?

5

Log In or Sign Up to add a comment.- 1

arrow-eseek-e1 - 3 of 3 itemsFacebook Comments