When your vote helps elect Rankin MacSween as the new mayor of the CBRM - 2 months from now in October 2016 - there will be several important reasons. Here's one that is vital to our future.

For starters, he's able to communicate some basic math that matters to every member of the Cape Breton Regional Municipality. But, first, did you know the following?

The CBRM is the Highest Taxed in ALL of Nova Scotia

Cecil Clarke recently promised that he was not going to increase the tax rates. Now pause to think of what that actually means. That is only something that will impress you if you didn't already know you live in the highest taxed municipality in all of Nova Scotia.

When you are the highest taxed municipality in all of Nova Scotia, you certainly hope things aren't going to get even worse.

Not increasing CBRM's highest taxes is like being told you have lung cancer, but it won't go to your brain. It's not the same thing as getting better. It doesn't improve your wellbeing.

Do you feel like you get the same level of service as Halifax?

One thing is for sure. You pay more for your home than those who live in an area of rural Halifax similar to your own. It's not fair, and it's a part of the reason the CBRM loses what some estimate to be 1,000 people every year.

The CBRM is helping to drive them out with our tax rates. They have to pay more with little to show for it. And it gives them (or us) another reason to finally give up and leave.

Rankin Has Some Quick and Easy "Flatbed Truck" Math That You Have to Know

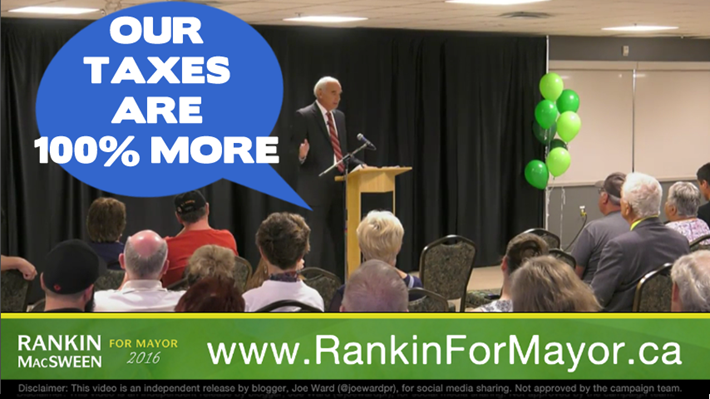

You can watch the video of Rankin speaking about the tax rates. It's just over 3 minutes in length. If you don't have time, I'll summarize the comparisons he gave in some quick tables below. This isn't dull math, or difficult math. But it affects your life.

Share with: https://youtu.be/npDnWlGoMzM

CBRM Residential Housing Tax Comparison

Rankin asked us to think about a home valued at $100,000 in rural CBRM. Then he compared the tax we pay here on average versus other municipalities. Here are the results:

| Compare To | They Pay | You Pay | Bad News |

| Richmond County | $780 | $1,900 | You pay more than double |

| Halifax | $1,160 | $1,900 | You pay almost double |

| North Sydney (Downtown) | $2,100 | $1,900 | Both in CBRM. Both bad news. |

| Antigonish (Downtown) | $1,000 | $1,900 | You pay almost double |

"What we're doing in the CBRM, is we're taxing ourselves out of investment. And we're taxing ourselves beyond growth. That's what we're doing" - Rankin MacSween, 2016

CBRM Business Tax Comparison

He then repeated the exercise using a business location instead of a home. Think about a business in North Sydney with an estimated value of $100,000.

| Compare To | They Pay | You Pay | Bad News |

| Antigonish | $2,600 | $5,200 | You pay double |

"If you want businesses to start, if you want businesses to grow, you have to create a context. You have to create an environment for that to happen." - Rankin MacSween, 2016

What is Rankin's Tax Plan?

Rankin wants to start lowering home and business taxes. He wants to reverse the damage that helps drive us away, and that gets in the way of our potential for growth.

However, you cannot simply lower taxes all at once. So when the tax lowering strategy he proposes begins, he says it will be phased over 4 years of his first term as mayor. This will start moving us in the right direction without disrupting CBRM revenue.

We grow tax revenue by:

- enabling new people to buy homes for the first time,

- creating an environment where people will decide to build new homes,

- making it feasible for families to buy a bigger home as they grow,

- attracting new businesses,

- increasing home values as people decide to make improvements and investments they choose to make, and

- bringing Cape Breton families back home again, as well as inviting others to live here for the first time.

Those are the kind of decisions people can make when we remove deterrents just like our unreasonable tax rates. We don't want our real estate agents to have to wince whenever they are asked about the annual taxes by a potential buyer.

How Do High Taxes Impact Us?

- It makes it harder for you to afford a mortgage or buy a more expensive home, or get bank approval.

- In Halifax and Antigonish, they can buy a house $15,000 to $20,000 more than your $100,000 home, and still pay the same mortgage and tax total each month.

- The extra $75 or more every homeowner pays in tax, every month, could be spent at local businesses! Spending in our economy creates jobs.

- When homeowners fall far behind on taxes, the CBRM will sell your home in a tax sale.

- If you're selling your home, new owners are put off by the high tax rates they will have to pay.

- For struggling families, every dollar extra they have to pay for tax is another they could be investing in the wellbeing of their family.

- For families doing well, every dollar extra they have to pay for tax is another they could be investing in their retirement fund.

- Higher tax rates require landlords to charge higher monthly rent charges to those forced to rent.

- Delaying home ownership for financial reasons can delay some responsible young couples from starting a family. They are the very roots of our next generation.

- The tax rates may disincentivize our Western workers from the decision to stay in Cape Breton. They are weary from their travels and time away from family. We cannot give them additional reasons to depart from us.

With child poverty at 42.6% for children 6 and under in the CBRM, can we really afford to take thousands of dollars of food out of their fridge and cupboards?

- Should they have to have cold nights when the oil runs out?

- Should they have to be uprooted every time their parent(s) can't pay the rent again?

- Should they have to go to school ashamed at what their family can't afford to provide, instead of optimistic about learning and playing with their friends?

- Should they have to endure the burden of seeing their parents slide into a bottle of booze or pills when they can't handle life's challenges?

My questions aren't dramatizations. It's the reality here in the CBRM for many. And with almost half of our youngest children living in poverty, it's almost certain that someone in your family or friends is impacted. Maybe it's you.

Economics is a cold word tossed around by academics. But taking money out of the pockets of families in one of the most struggling municipalities in all of Canada is something we can understand. Be it tax rates, high energy or fuel costs, lack of employment or underemployment, it's a hard go.

It's a hard go that convinces people, it might be time to go.

Rankin MacSween wants to remind us about this math, these numbers, and what it means for our wellbeing and our future.

Share this article to your Facebook and turn it into a discussion.

It's the kind of discussion we need to have, don't you agree?

7

Log In or Sign Up to add a comment.- 1

arrow-eseek-e1 - 4 of 4 itemsFacebook Comments