The following was submitted this morning to the CBRM Mayor and Council. The NSEF is rquesting time to present the following information to the CBRM.

We will advise you when we hear back from the Clerk's office.

Here is what was sent:

December 6, 2024

Dear Municipal Clerk’s Office of the CBRM:

We formally request the opportunity to make a presentation to Mayor and Council on the topic of property taxation in the CBRM.

Please advise us by return email when we can present.

Regards,

Rev. Dr. Albert Maroun on behalf of

The Nova Scotians for Equalization Fairness

And here is the presentation we submitted for approval:

To Mayor and Council:

Request to Municipal Clerk’s office to present to CBRM Council.

Presenters on behalf of the NSEF:

Russ Green (Introduction and NSEF’s position)

Charles Sampson (Discussion of Ayman Nadar’s report on Section 36 of the Constitution of Canada)

Dear Mayor and Council:

The current tax rates in downtown Sydney are more than double than downtown Halifax.

Section 36 of the Canadian Constitution Act of 1982 states:

Commitment to promote equal opportunities

• 36 (1) Without altering the legislative authority of Parliament or of the provincial legislatures, or the rights of any of them with respect to the exercise of their legislative authority, Parliament and the legislatures, together with the government of Canada and the provincial governments, are committed to

o (a) promoting equal opportunities for the well-being of Canadians;

o (b) furthering economic development to reduce disparity in opportunities; and

o (c) providing essential public services of reasonable quality to all Canadians.

• Marginal note: Commitment respecting public services

(2) Parliament and the government of Canada are committed to the principle of making equalization payments to ensure that provincial governments have sufficient revenues to provide reasonably comparable levels of public services at reasonably comparable levels of taxation

The Members of Parliament of Cape Breton, past and present, have failed to provide the NSEF with the legal authority to transfer these billions yearly to Nova Scotia “unconditionally” after almost 20 years of asking. The constitution is clear on the intended purpose of equalization yet the residents of the CBRM are faced with unconstitutionally high property taxation. Roughly 20% of the total transfer is sent because of a municipal deficiency in fiscal capacity related to property and miscellaneous revenues. We can not raise enough revenue in taxation to deliver services to a Canadian standard.

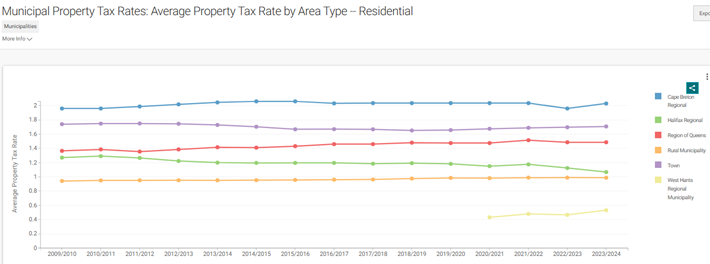

The above chart clearly shows that the CBRM has the highest property taxation in the province of Nova Scotia and that our taxation rates are trending even higher. The chart also shows that the HRM has one of the lowest taxation rates and they are trending lower as we increase. The other communities are remaining unchanged, and those communities are not feeling the pain that the CBRM is feeling.

The RCMP has investigated the claims of the NSEF over an 8th month long investigation and they agreed with our claims. They stated that they did not possess the powers to police anything past section 35 of the Canadian Constitution.

What can be done to seek justice?

A human rights complaint or a Charter of Rights and Freedom challenge is a starting point. The NSEF is prepared to publish an ad in Canada’s national newspapers (The Globe and Mail and the National Post) to seek for a constitutional lawyer who might be interested in taking our Charter challenge or human rights complaint and represent the CBRM in Ottawa.

The CBRM is being used to generate much funding for the province because of our poor fiscal capacity and that is a fact. The CBRM can no longer allow this constitutional injustice we endure at the hands of the provincial government. We must put party politics aside and we must stand up to our abusers.

We have presented in the past to council, a set of questions that we asked the CBRM council to submit to the province for answers. That was done several years ago, and we have never received an answer. It is time for the CBRM to take ownership of this issue and demand a response from the provincial and federal governments on behalf of the overtaxed residents of the CBRM.

The NSEF has had unanswered correspondence now for years with the past three Justice Ministers and Attorney Generals of Canada. Our MPs from Cape Breton and our MLAs have all neglected the issue of equalization unfairness.

This mayor and council must take a stand with the province on the equalization issue. When our residents start to lose their homes, it will be too late. People who have recently moved to the CBRM are paying some of the highest property taxation in North America. There is no room to raise our property taxation further and the property taxation rates must be lowered if we want this community to grow and prosper. The residents of this municipality are beyond frustrated with the growth of Halifax while we continue to decline without any transparency or accountability from all levels of government regarding the equalization transfers.

Will this mayor and council finally stand up for the overtaxed residents of the CBRM?

Reference Section:

Please reference page 358 to page 367 of the link below to see the federal responsibility and that “equalization” must have conditions.

https://core.ac.uk/download/pdf/288305084.pdf

"Paliament and the federal government must also place conditions on the use of federal grants to the provinces in or

der to ensure that "all Canadians" are provided with essential public services of "reasonable quality".

Complying with the Constitution of Canada is the responsibility of all Canadians and not just government. A legal ruling for the Supreme Court of Canada in a 1950 ruling states:

“The constitution of Canada does not belong either to Parliament, or to the Legislatures: it belongs to the country and it is there that the citizens of the country will find the protection of the rights to which they are entitled.”

The NSEF Requests To Present To Council On PropertyTax Rates

Posted by

Nova Scotians for Equalization Fairness

Receive news by email and share your news and events for free on goCapeBreton.com

SHOW ME HOW

https://capebreton.lokol.me/the-nsef-requests-to-present-to-council-on-propertytax-rates

Gov Government News Federal Government

Gov Government News Municipal Government

Gov Government News Provincial Government

Gov Political Commentary

Location Canada

Location CBRM

Location World

View all the LATEST

and HOTTEST posts

and HOTTEST posts

1

Log In or Sign Up to add a comment.- 1

arrow-eseek-e1 - 1 of 1 itemsFacebook Comments